Aptima expects to create 15 new full-time positions, generating $1.1 million in new annual payroll and retaining $3.2 million in existing payroll as a result of the company’s expansion project, according to a news release.

For six years the company can claim a 1.375% credit on the state income taxes on the new jobs in Fairborn. The company is estimated to save about $95,000 over the life of the credit, depending on how many people it actually hires.

The expansion will take the company from 30 to 45 employees.

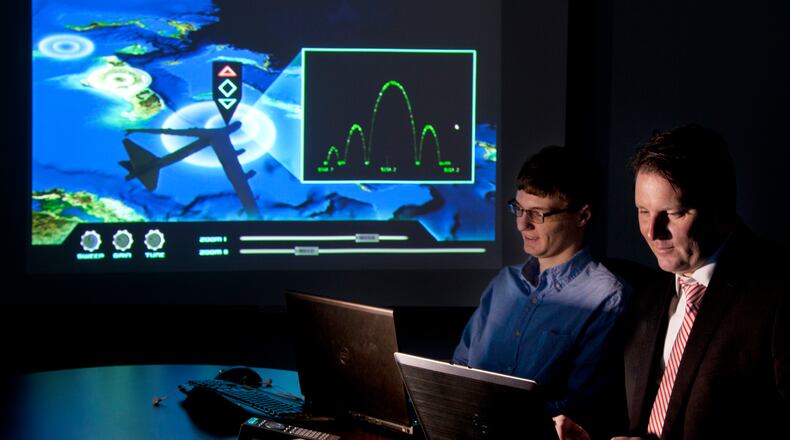

Aptima is a company of scientists and engineers who work to improve the performance of warfighters in complex, technology-rich environments, said Mike Garrity, executive vice president of government relations. Complex environments mean environments where making a wrong decision could have “real implications,” he said, like military, health care and law enforcement.

Garrity said the savings from the tax credit will be able to be reinvested into more research and development.

“That spurs the next great idea that we can work with the Air Force to ultimately develop and transition into the field,” Garrity said.

The company gives recommendations for precision training and on-the-job augmentation by combining sensing and assessment technologies with advanced analytics based on models of human performance.

Garrity said an example of the company reinvesting into research and development is the creation of spin-off company Sentinel Occupational Safety Inc., which uses technology developed by Aptima in the commercial world.

It employs sensors and software and has been reconstituted into a system that monitors workers in hazardous settings. The technology, called SafeGuard, was borne of hours of work with the Air Force and elsewhere, devising a way to monitor worker safety. SafeGuard offers an “Internet of Things” approach, combining sensors, wearable belts and monitors with data analytics, to keep tabs on workers in dangerous settings.

The idea is to detect and alert workers to problems with time to spare and allow one person to monitor a few different workers, making the process more efficient. In the Air Force setting, this technology monitors heart rate and oxygen levels for repair crews in or near fuel tanks in aircraft, Garrity said.

As part of its growth, Aptima plans to add data scientists, software engineers, artificial intelligence and machine learning experts, and industrial and organizational psychologists. Aptima expects to create these jobs and maintain existing payroll by the end of 2023.

“These are very high paying jobs,” Garrity said. “Most of these employees will likely have families, so they’re going to be investing in their local communities. We have folks scattered all over the region. So, these are investments that don’t apply only to Fairborn, it certainly applies across the various towns around the area.”

As part of the tax credit agreement, the state requires Aptima to maintain operations at the project location for at least nine years.

Aptima was founded in 1995 in Woburn, Mass., and established a Dayton-area presence in about 2007, drawn in part by the creation of the 711th Human Performance Wing at Wright-Patterson Air Force Base. By 2013, the wing was one of the company’s biggest customers.

Aptima continues to work with the Air Force Research Lab to measure performance and stress in warfighters, such as pilots.

The company also plans to bring aboard 10 interns this summer, Garrity said. The company has built a strong relationship with The Dayton Regional STEM School, as part of its commitment to building the next generation of talent for the company and region’s success, Garrity said.

Fairborn Assistant City Manager Mike Gebhart said the city is thrilled to have the company stay and expand.

“This is a win for Aptima, a win for us and a win for the base,” Gebhart said.

Gebhart said the city will benefit from additional income tax revenue and could potentially benefit from property tax if some of the new employees chose to live in Fairborn.

Ohio Gov. Mike DeWine and Lt. Gov. Jon Husted announced Monday the approval of assistance for nine projects set to create 3,214 new jobs and retain 4,520 jobs statewide after the Ohio Tax Credit Authority’s monthly meeting.

Collectively, the projects are expected to result in more than $187 million in new payroll and spur more than $606 million in investments across Ohio.

About the Author